From climate change to animal welfare, shareholders are using stock certificates and SEC filings to push food companies to do better.

From climate change to animal welfare, shareholders are using stock certificates and SEC filings to push food companies to do better.

April 9, 2018

The green straw is nearly iconic. Sticking out of a plastic cup filled with creamy coffee and swirls of chocolate, the straw says “Starbucks” almost as clearly as the coffee giant’s logo. Now, a group of shareholders is asking Starbucks to do away with its signature straw—and the environmental damage disposable plastics can cause.

On March 21, actor and activist Adrian Grenier asked Starbucks shareholders to vote for a proposal to phase out the use of these straws and make the company’s other packaging more easily recyclable. Investors representing 29 percent of Starbucks’ shares did just that. Facing such vocal advocacy, Starbucks is making some moves in this more sustainable direction. Even before the vote, the company announced a plan to invest $10 million in developing greener to-go cups.

“It’s nowhere near enough, but a typical initial corporate move to acknowledge some responsibility,” said Conrad MacKerron, senior vice president for As You Sow, the nonprofit that introduced the measure.

And this effort is just one of the latest in a rising tide of shareholder activism aimed at making the food we eat healthier, environmentally friendly, and financially sustainable.

As You Sow and other groups like it—many of which are run by groups of nuns with sizable retirement funds—work to organize those who own stock in large public companies in an attempt to influence the businesses’ policies or practices. It’s a decades-old approach commonly associated with hard-nosed investors demanding mergers or layoffs in an attempt to pump up short-term earnings. The goal of the strategy is generally to engage with the company’s leaders directly; if that doesn’t work, activists can then file proposals to be voted on at the company’s annual shareholder meeting.

The tactic is increasingly being put to use by groups with social or environmental goals: asking companies to better assess their carbon emissions, addressing gun violence, or curbing executive pay, for example. In 2012, shareholders filed 393 proposals focused on social and environmental concerns, according to the Sustainable Investments Institute; last year that number was up to 494.

Resolutions may not effect change directly, but they can spark public attention or highlight the urgency of issues companies had previously overlooked. In 2017, As You Sow asked Mississippi-based Sanderson Farms–the country’s third largest poultry producer–to phase out the use of antibiotics, citing evidence that antibiotic use in meat production is linked to the rise of antibiotic-resistant infections, as well as the fact that Sanderson’s leading competitors Tyson Foods and Perdue have made pledges to move their supply chains away from antibiotic use.

When the company refused, As You Sow filed a shareholder resolution on behalf of concerned investors; at the company’s next annual meeting, investors who own 43 percent of Sanderson voting shares supported the proposal—an impressive number for an environmentally focused resolution.

“The support for change is overwhelming,” said Austin Wilson, environmental health program manager at As You Sow. “It’s an important sign that a company’s investors are looking for a certain course of action.”

Food-focused shareholders are using their power to push for a range of issues, from improving working conditions at major food companies to eliminating nanotechnology in ingredients. Environmentally focused investment advisor Green Century has engaged with J.M. Smucker, parent company to brands including Folgers, Pillsbury, and Jif, to increase transparency regarding pesticide use. The Interfaith Center on Corporate Responsibility (ICCR) is talking to large companies including Costco and Hilton about ways to reduce food waste.

Despite its generally progressive goals, this kind of shareholder activism is an essentially capitalist endeavor, using market forces and the incentive of profits to drive change. The goal, said Wilson, is to advocate for policies that have long-term impact not just environmentally or socially, but financially as well, to demonstrate that ethical changes can also be profitable.

“Long-term shareholders need to be more represented than the Wall Street companies that are just concerned with quarter-to-quarter results,” Wilson said. “We want the entire company to be around in 100 years.”

And there’s evidence that the strategy can be effective.

Many companies targeted by activist investors have moved their practices in more sustainable directions, though few appear willing to acknowledge that shareholder pressure played a role. In just the past year, following related shareholder actions, McDonald’s has agreed to recycle all post-consumer packaging at its restaurants, Dunkin’ Donuts’ parent company has announced a plan to phase out the use of polystyrene cups, and Burger King, Starbucks, and KFC all agreed to reduce use of antibiotics in their poultry supply chain.

Organizations like As You Sow and ICCR bring together institutional and individual investors to amplify their influence. These groups research issues related to their missions and identify companies whose practices they believe need improvement. Members and partners of these organizations might buy shares specifically to get themselves a seat at the table when an issue is particularly important to them.

They then begin their campaigns by contacting companies, explaining their case, and attempting to convince the board and executives that change is in their best interest. ICCR is currently engaging with a number of large companies including Costco, Whole Foods, Denny’s Corp., Domino’s Pizza, and Yum! Brands (the parent company of KFC, Taco Bell, Pizza Hut, and other fast food restaurants) on antibiotics and food waste reduction.

If the companies are not responsive, many organizations will then submit a shareholder resolution, a proposal of no more than 500 words that suggests a course of action for a public company. The investor who makes the proposal files it with the Securities and Exchange Commission (SEC); the company then has the right to challenge the resolution. If the SEC allows the resolution, it becomes public and must be voted on at the company’s annual shareholder meeting.

Sometimes, simply filing these proposals is enough to make a company rethink its position. The company may offer a concession if the filing organization agrees to withdraw the resolution, thus avoiding the potential hit to their reputation should the issue make headlines.

“Companies do not like the fact that these proposals become public,” said Nadira Narine, who oversees food and water issues for ICCR. “It is our major leverage and negotiating tool with a company.”

A company that holds its ground and lets a resolution come to a vote could also take a financial hit, according to research by Brayden King, professor at Kellogg School of Management at Northwestern University.

In a 2012 study, King concludes companies that have been the subject of these resolutions are more likely to be rated by analysts as environmentally risky, even if their practices are no different from companies who were not the targets of activist shareholders. This higher risk rating has a negative effect on financial performance.

When proposals do get voted on, they hardly ever receive majority support; only four environmentally oriented resolutions and no food-specific ones crossed the 50 percent threshold in 2017. And they are not binding even when they do receive a majority.

What’s more, it often takes several years for resolutions to pick up a significant number of votes—but most shareholder activists propose them several years in a row to gain traction. A resolution can be re-introduced in subsequent years if it receives at least 3 percent of the vote in its initial submission.

Still, the process undoubtedly makes a difference, King said.

“We know for sure [shareholder activism] helps drive the agenda of issues boards and executives consider,” King said. “It can change the discussion.”

There are, of course, those opposed to socially responsible shareholder activism. Right-leaning groups including the Competitive Enterprise Institute and the U.S. Chamber of Commerce have argued that special-interest shareholder proposals damage a company’s bottom line and hurt investors.

And, indeed, not all proposals promise the financial sustainability Wilson says As You Sow strives for. A 2016 Harvard Business School study showed that resolutions related to “immaterial issues”–issues that are not likely to make investors rethink their investment–often damage the overall valuation of the company.

Furthermore, the work can be slow going. ICCR’s Narine points to the issue of antibiotics. Though many companies are jumping on the bandwagon recently, Narine notes that groups like hers first started reaching out to companies 10 years ago.

“Don’t expect change in six months,” Narine said. “You’re in it for the long term.”

September 4, 2024

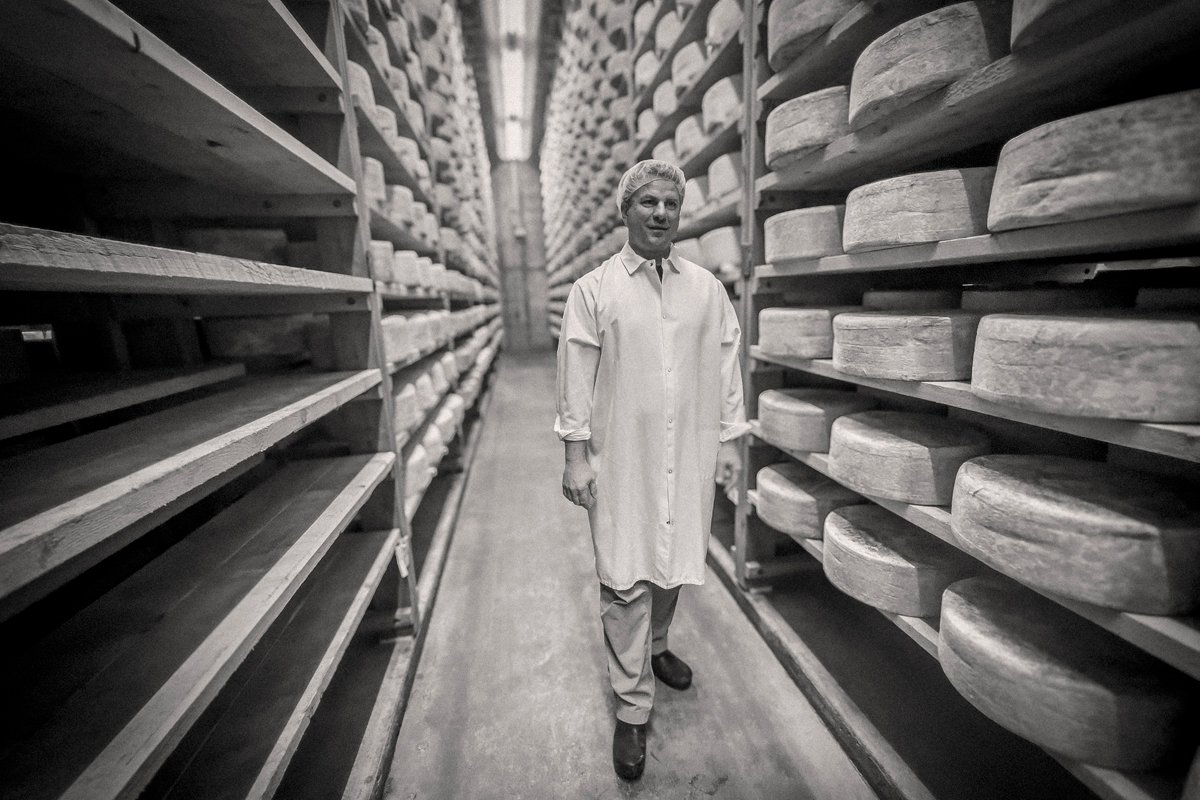

By paying top dollar for milk and sourcing within 15 miles of its creamery, Jasper Hill supports an entire community.

September 3, 2024

August 27, 2024

August 26, 2024

Like the story?

Join the conversation.